SEC Database AutoScreener

Investment screening tool, built using polars and the public SEC API

A deceptively difficult data analysis problem.

Need

As a college student heavily involved within the Jenny Investment Club, one of the United States’ oldest and largest fully student-run investment groups (we collectively handle over $10 million!!!), part of club operations involves having club members find stocks for us to invest within.

As a club, we have a variety of different hard and soft guidelines to help us screen through stocks, such as:

- 1 - 10 billion market cap (inclusive)

- ESG considerations (we are a middle eastern liberal arts college)

- Portfolio Diversification. Would this stock overexpose us to a certain sector’s risks?

- 15% average growth, over 3 or 5 years in:

- Cash Flow

- Revenue

- Income

The most difficult quantitative benchmarks to pass are the various 15% growth metrics. These are actually somewhat hard to find, because they are commonly not possible screening axes within free screeners, and booting up excel and tracking down historical company data across balance sheets and income statements is tedious, especially in the early stages of stock research.

I wanted to solve this problem to make my fellow club members stock research jobs a little bit easier. I initially started using the yfinance package within python, however I ran into multiple difficulties very quickly, in limited scope of data, validity of data (sometimes just wrong??), etc.

I then discovered that the SEC itself has a public API endpoint for looking up company information, documentation here.

Technologies

As this is less of a software engineering project and closer to that of a data analysis problem, I tried to keep things as simple and easy to change as possible by using a jupyter notebook for the data.

Additionally, as I knew I was going to be doing datawrangling with a project such as this. However, I am only a novice working within pandas, so I instead capitalized on the opportunity to work with polars, a new rust-based dataframe library!

Polars has a multitude of benefits (and negatives) to consider, but for a simple project of my scale, anything would do, so why not dip my toes into the polars syntax?

Additionally, I was doing RESTful API queries, so I utilized some very simple functionality that comes with python’s built in requests library.

Then, you would imagine the problem is pretty simple, correct? Just:

- Follow SEC instructions to get all company CIKs (their database’s lookup key)

- Find the CIK for a chosen stock of interest

- Construct API queries for information on stock about desired metrics

- Simple pct-change analysis

- Results

… not quite …

xBrl (and why I won’t be a business person)

xBrl, or eXtensible Business Reporting Language is a somewhat standardized flavor of XML for understanding business reports from companies, such as 10-Ks, 8-Ks, 20-Fs (for foriegn companies), etc. Without getting into the details of constructing specific API queries, it is easiest to get historical data of a specific xBrl tag. For example, if I identify the Revenues xBrl tag, then I can get the historical amounts for every form in a specific company’s record. Then pipe this to filter for only yearly reports, and it should be easy to have a YoY percent change for our desired metric.

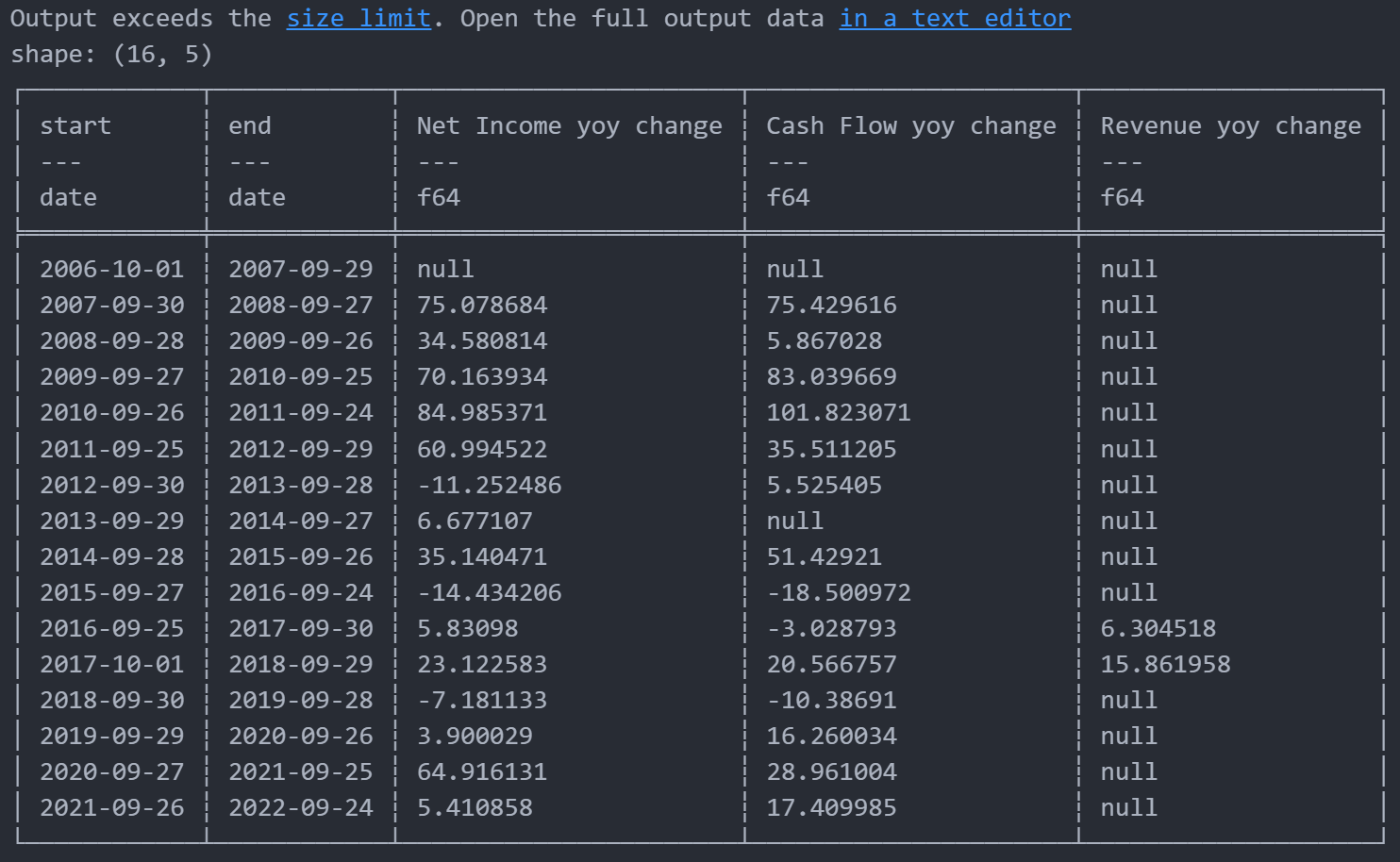

However… there is a big assumption here, in that the company is going to always going to tag their choice financial data under the exact same xBrl tag. For example, here is a example output after cleaning and filtering a query on $AAPL:

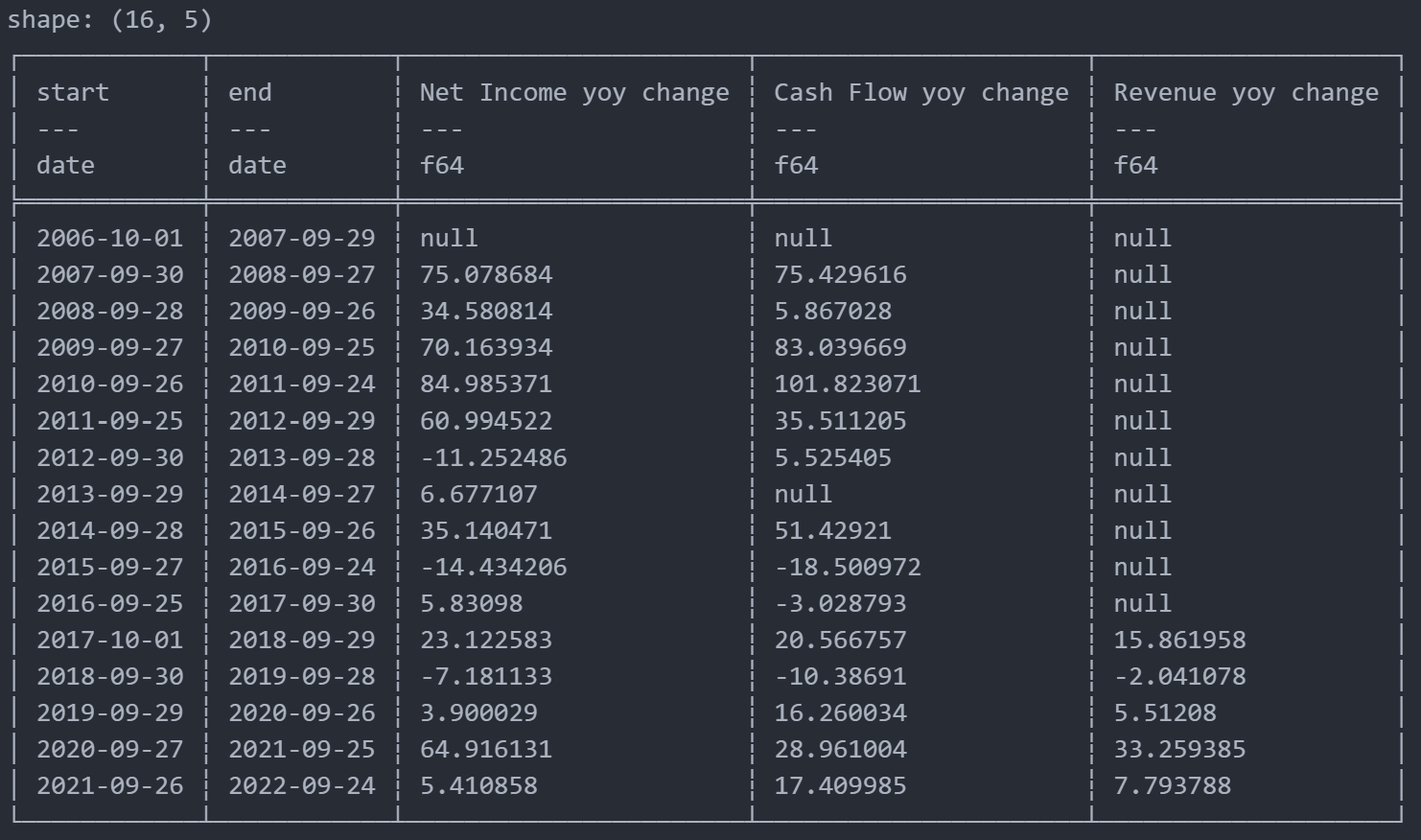

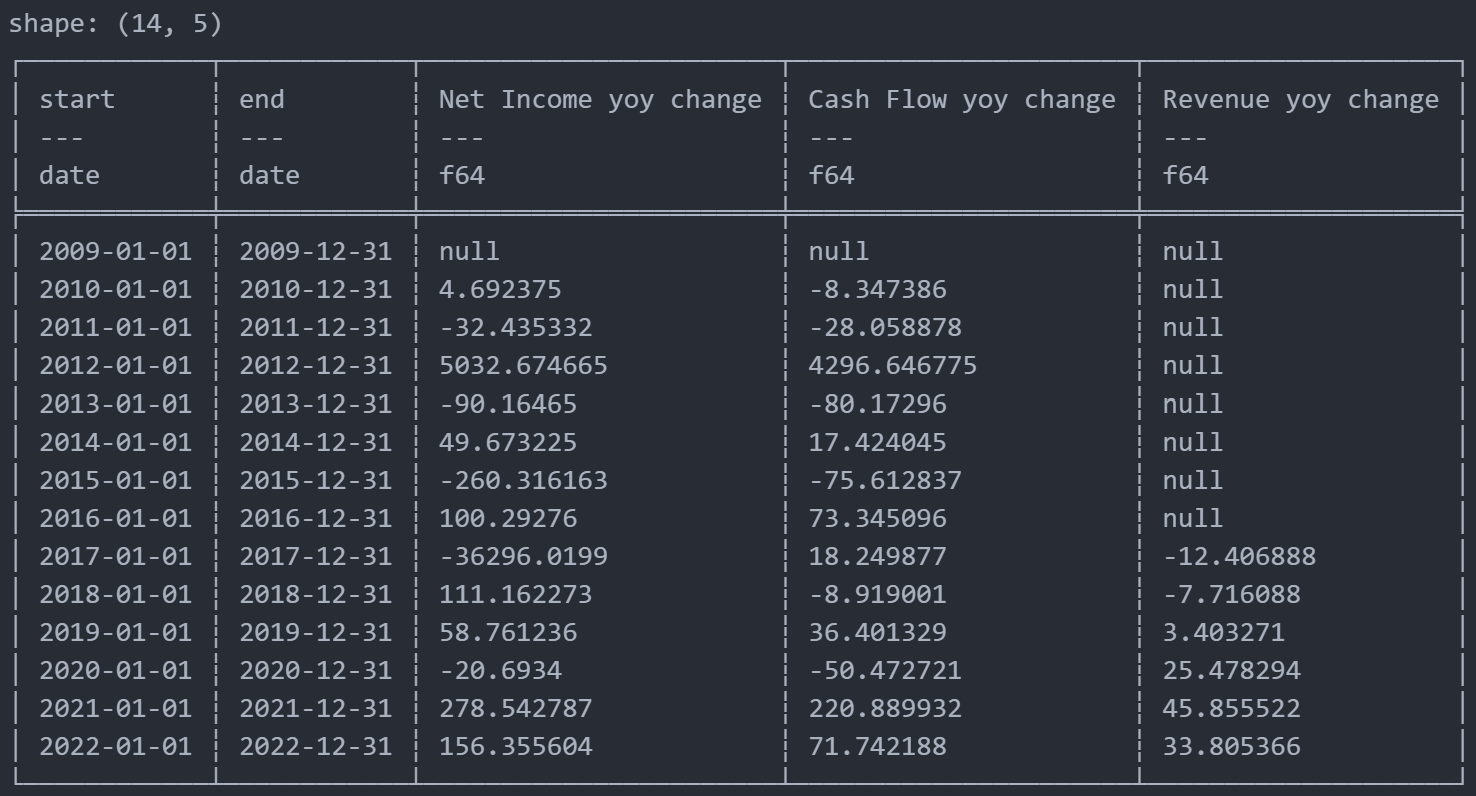

Here, it is obvious that the query for revenue didn’t use the right xBrl tag. Looking into it, that column was made with "RevenuesTotal" as the API endpoint. So, below are two more graphics. One is another AAPL query with a different Revenues endpoint. Another is a query on a different company, still with the “RevenuesTotal” endpoint tag.

So here, we see the root of the issue: while companies tend to be self consistent in their business tags (but not always), they differ from business to business as far as I can tell. Additionally, there does not seem to be a completely standardized selection of which xBrl tag is used – although there are a few that are the most common, it is entirely possible that some companies will use a completely different tag for a certain accounting number.

I have faced a lot of challenge in trying to think of a repeatable, short, and quick to-implement solution to this problem, and have not had a ton of luck. For this scale of project, I believe it would be a rabbit hole to go down if I were to try and use CV parsing libraries to extract a specific xBrl tag, although larger companies and paid APIs do complete this service, I believe.